We’ve managed to drag ourselves away from Clubhouse for a few hours to pull together some great subscription stories. The only unifying theme this week are the elements that are making subscription services work. We’re wary of easy answers, and copying what works in one business to another, but there are some general themes emerging.

From Grow & Retain

Numbers that matter in the subscriber journey

Comparing your metrics against those of other similar businesses can be useful because of the questions it forces you to ask about your performance. Piano.io has benchmarked data on the subscriber journey from 284 media companies. The data prompts a lot of questions. If only 3.6% of visitors are properly engaging, how do you increase that number? What, in the subscription messaging or process, is making 21.8% of people switch off auto-renew on the first day? If registered users are 10 times more likely to subscribe, how do you get people to register? Read more.

In case you missed it…

Subscription apps boomed in 2020

The top 100 subscription apps on iOS generated $10.3 billion in 2020, according to new data from Sensor Tower. That’s an increase of 32% on 2019. The growth was likely fuelled by people being forced to stay at home due to the pandemic. 2020 was a bumper year for mobile in general with 218 billion new app downloads and users spending 4.2 hours per day in apps. Surprisingly, the top subscription app was YouTube. The paid option is growing in popularity as it removes ads, offers offline viewing, and has extra channels like Music and Kids. Read more.

+8 million subscribers in just one month

Disney+ finished 2020 with exceptional figures, reaching 94.9 million subscribers. That meant they added more than 8 million in December. Content played a key role in driving those numbers, with Pixar’s “Soul” and Season 2 of “The Mandalorian”. On the back of this growth, Disney upgraded its target subscriber numbers, aiming to reach 260 million by 2024. Disney’s bundling of verticals, for example Marvel, Star Wars, National Geographic and Disney, has worked well. It’s about to be extended with the addition of Star programming. Read more.

Remote work as a service

Fiverr, a platform that connects businesses with freelancers offering digital services, is launching a subscription service. Up until now, businesses made a one-off purchase, for example getting a banner designed for a website. Last year, Fiverr facilitated 2.8 million service purchases. Fiverr have noticed that companies are tapping into remote services more, in part due to the pandemic. There is clearly a business need for services on an on-going basis, so Fiverr have launched subscriptions. Freelancers can now offer services for 3 or 6 month durations. This is a smart move made to keep the transaction happening on the platform. We expect to see more freelance subscription services emerging. Read more.

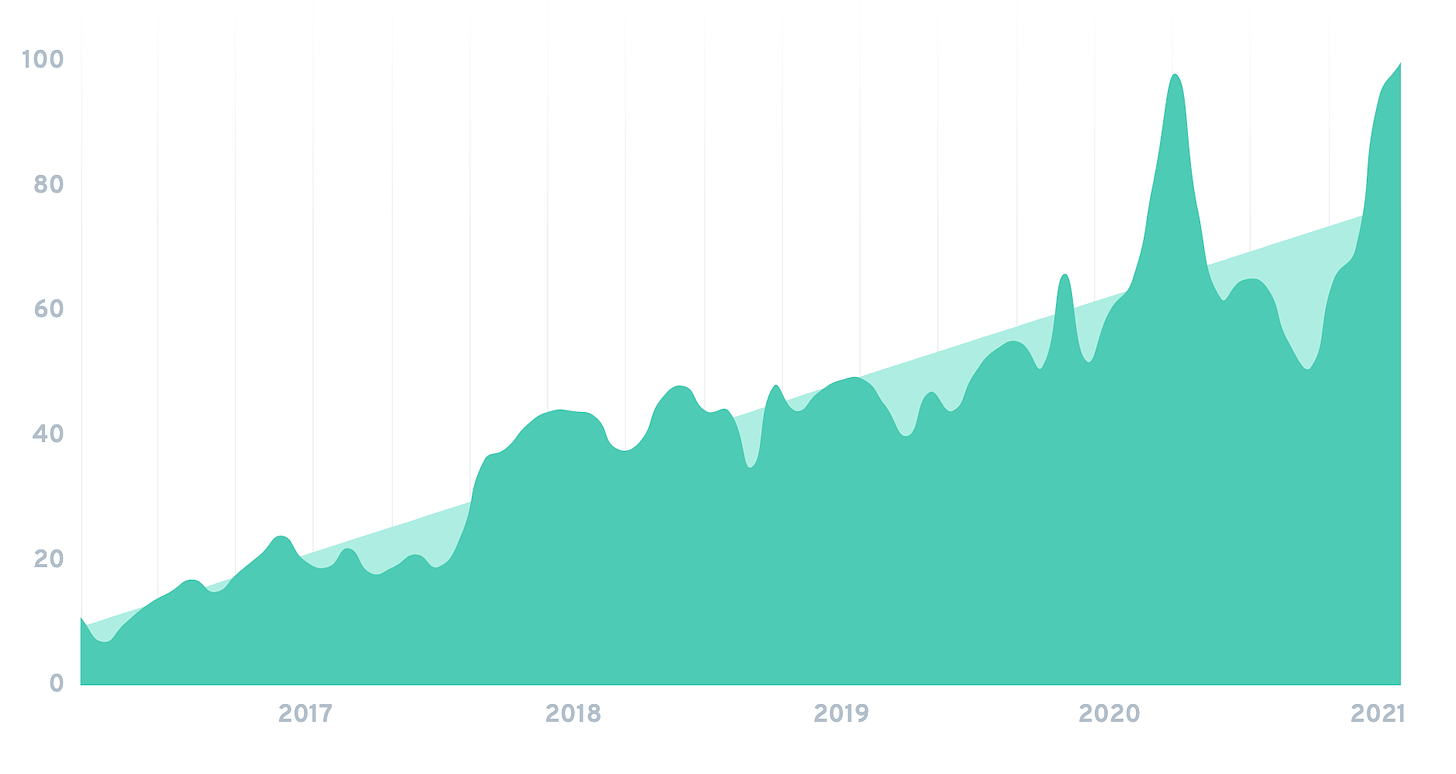

Winc

We like a good graph, and this one from Exploding Topics caught our eye. It is for wine subscription box service Winc. The company looks to be experiencing 8 times growth over the past 5 years, with the last 12 months seeing even higher growth due to the pandemic. Winc is one of a number of alcohol subscription boxes, and very much part of the growing trend of D2C. They also face competition from Wine.com an established e-commerce business who have their own subscription offering - StewardShip which grew sales by 189% last year to $189 million.

ESPN puts more writers behind the paywall

23 of ESPN’s writers, producing analysis-based content, are now exclusively for ESPN+ subscribers. This has effectively doubled the number of writers producing content behind the paywall. It would suggest that ESPN are confident that this type of content drives subscriber acquisition. It will also deliver more value to existing subscribers. ESPN+ is a unique mix of video streaming and written content. They expect to see people who have streamed video start to read, and those already reading consume more articles. ESPN+ reached 12.1 million subscribers in January. Read more.

Bloomberg verticals drive sign-ups

According to an internal memo, Bloomberg’s growth of its consumer subscription product has been driven by verticals in personal finance, climate, auto and the business of entertainment. Bloomberg expects to be generating $100 million in consumer subscription revenue in 2021. This is small in comparison to their core 325,000 customers signed up to their professional service. It is, though, another example of an offering of a range of complementary content-driven subscriptions. Read more.

Quick links

A selection of other stories that are worth a read.

Indie game producers Wired covers the impact on independent games producers as the subscription model gains traction in gaming.

Daily subscription Africa’s National Media Group launch their subscription product. Smart approach to mobile payments, but can a paid service work here?

Watch WPP CEO Mark Read talk about the future of advertising and much more. Important context.

So we don’t feel a little like we’re shouting into the void, feel free to comment on any of the stories and to let us know your thoughts. We think the discussion would be good for everyone.

Also, if you got some value from this week’s stories, please take a moment to share the email with others. Just click the button below.