This week’s newsletter was sent later than usual. I would like to claim I’m experimenting with send times to optimise open rates. But the reality is I got sidetracked by a couple of cancellation issues, you can read my tale of woe below.

In this better late than never newsletter we look at:

Digital driving unbundling

Social subscriptions

Amazon’s subscription marketplace

and much more.

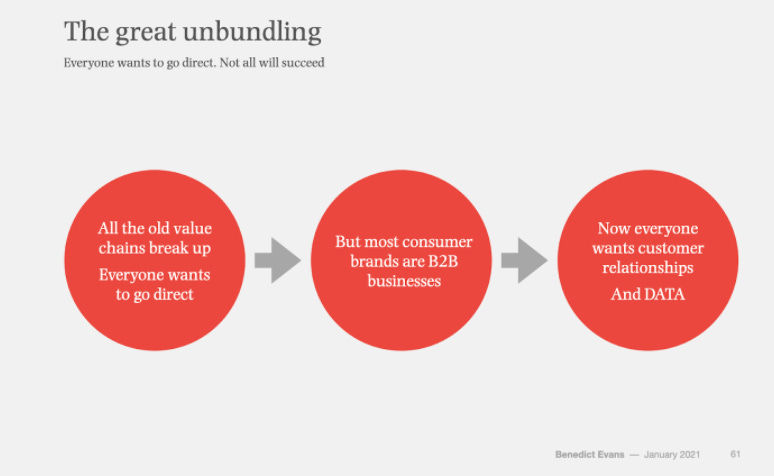

The great unbundling?

I’ve been reading Benedict Evans’ newsletter for years staring with his premise that mobile would change everything to software eating the world and beyond. His way of thinking about digital and business is refreshingly different and very smart. In this presentation he looks at the impact of what happened last year and trends moving forward.

It’s a broad presentation but it illustrates the context any business is operating in and what is influencing how consumers behave and we do business. Key points to note are:

The COVID lockdowns pulled forward a huge amount of future adoption - tellingly old habits were broken

Every part of the retail and media journey is being unbundled - but Amazon is bundling, as its third party sales continue to grow

Brand and consumers are ready to go direct and lockdowns have expanded the funnel - users are looking for products on platforms other than Google and Amazon. The internet is also moving up the funnel - people used to search for the “cheap” on the internet, now they search for “best”

40% of Nike’s revenue is now D2C - they are the number one global fashion site with 150 million uniques. Interestingly they pulled out of Amazon in 2017.

Advertising market is being disrupted, not least by the “cookie apocalypse” - first party data is vital

But do you even need “advertising”? Kylie Cosmetics $900 million valuation shows the power of social

Daily video viewing minutes of 16-24 year olds changed dramatically due to lockdowns - in the UK Netflix and YouTube are both watched more than “live TV”.

Everyone wants to go direct but most businesses have no idea how to do this. They’re B2B businesses, they’re not used to customer relationships, consumer marketing and how to use data

As I mentioned it’s a very high level picture but it covers some important changes and trends, you can view it here but it might help to watch it being presented by Benedict here.

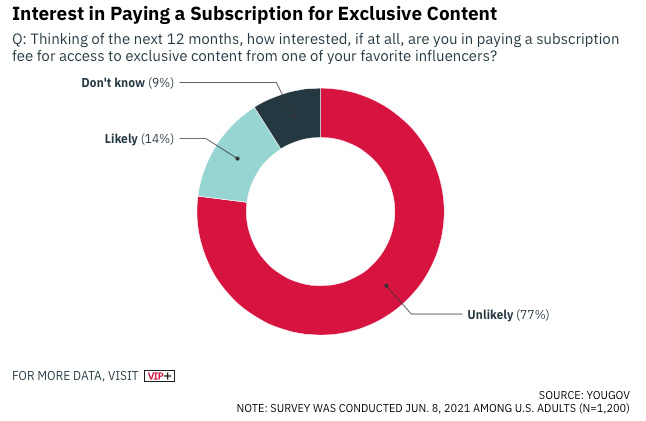

Social subscriptions

According to a recent survey by YouGov less than 2 out of 10 of people would be willing to pay for exclusive content from their favourite influencers. Which doesn’t bode well for YouTube which already has a creator subscription system, Twitter which is launching one and Instagram which is rumoured to be considering subscriptions. But, the data above is significantly skewed by demographics. Not surprisingly close to a quarter of 18-29 year olds would be willing to pay for exclusive content. This level of willingness to pay would seem to indicate that there is a sustainable freemium model for influencers / creators. This is also borne out by services such as Patreon.

The survey also looked at what platforms people used to follow influencers (see below), Facebook is surprisingly strong and by contrast Twitch looks very weak. Twitch in fact has a thriving subscription / patronage service for creators, which is helping musicians according to a New York Times piece. For more detail on the survey - Read more.

Purpose drives subscriptions

I’ve been following Quartz since it’s launch by Atlantic Media. Its been a journey with plenty of twists - a surprise sale to Uzabase for over $75 million, a shift to subscriptions in 2018 and ultimately a management buyout late last year. Quartz seemed to be another digital media business destined to wither. However the management team re-focused on what need Quartz was going to fill. This has resulted in a strong mission - to “make business better”. I was sceptical about this, but it seems this is not an empty tagline. Editorial has improved and is asking hard questions of business. Having a real purpose seems to be working with subscriptions surging by 28% since September last year. Read more.

Amazon’s subscription marketplace

Just over 60% of Amazon’s GMV comes from third party sellers on its marketplace. Now it appears Amazon is extending this to subscription boxes. For sometime (surprisingly in the US only) they’ve had a dedicated marketplace for subscription boxes, worth taking a look here. Amazon now appear to be expanding the marketplace by attracting larger subscription box businesses such as BarkBox. They are also offering incentives for Prime members to subscribe. Discovery is a problem for D2C subscription services. An aggregation or marketplace would aid discovery, but becoming reliant on Amazon for new customers might come at a high price.

Email marketing periodic table

MarTech have produced a great piece of content marketing, packaging a guide to email as a periodic table. For the most part it isn’t too contrived and there are some great tactics for anyone using email in their subscription marketing. A few tactics / tips that stood out:

Average open rate for emails in 2020 was 18%, with 43% of those opens happening on a mobile device

Segmentation is vital for email success. Consider this not just on demographics or interests but on engagement with content or the inbox provider

Subject lines matter, experiment. Emojis make messages more relatable but make sure they’re relevant to your audience.

BIMI (Brand Indicator for Messaging Identification) still an experimental element but this offers the promise of brands being able to display their logo next to the sender name in the inbox

AMP (accelerated mobile pages) also applies to mobile and will enable confirmation buttons, rotating carousel images etc

You should be able to access the PDF here.

The reason why this newsletter is late this week

Last year at the beginning of the pandemic I bought a subscription to Zoom, partly for work but partly to keep my large family in touch. Initially I signed up to a monthly subscription but then prompted by Zoom’s marketing emails and a special offer I switched to an annual subscription.

During the year I needed to purchase Microsoft Office 365 and got Teams as part of the bundle. So I no longer needed Zoom. I made a note of the subscription end date and set an alarm to cancel the subscription. Yesterday I woke up to an email from Zoom, happily informing me that they’d debited my credit card for $179. When I checked, they had renewed the subscription a day before the old one was supposed to end. Looking back I could see one reminder email from Zoom, that got lost amongst 100s of others. And when I got in touch they agreed to a refund straight away. Even so the tactic of renewing before the current subscription has ended left a bad impression as did the time it took to navigate their chatbot and eventually request a refund.

But in contrast to Zoom, I managed to lose access to emails this week when my domain provider didn’t automatically renew my registration and email service (I had turned off the auto-renew). I spent a very anxious few hours trying to get everything back in place.

So how should renewal / cancellation be addressed?

It would help if companies stopped dark practices. This leads to consumer behaviours such as cancelling as soon as they sign up to a subscription.

Don’t treat every customer the same - take a look at the engagement and adapt marketing around cancellation / renewal accordingly.

Look at ways to cut through the email noise - sms or other messaging platforms.

Be open about how to cancel and make it simple.

And like Zoom respond quickly and fairly - if they hadn’t have agreed a refund I would have made sure I never used the service again and let other people know about my experience.

Quick links

B2B opportunity for news publishers according to a report from the INMA feeling subscriptions to companies rather than individuals is a significant new revenue opportunity. Strangely this piece cites the FT and Wall Street Journal as examples - difficult to see how a local newspaper could provide similar content?

Apple has finally launched its podcast subscriptions service globally. There are a significant number of established podcast producers including Luminary, Bloomberg Media and The Athletic available on the service.