We’re slightly delayed in getting the newsletter to you this week. Not only did we have to force ourselves to look away from the European Super League fiasco, but there was a slew of Q1 reporting that we thought was worth covering.

Subscription fatigue or too much choice?

Deloitte have published the 15th edition of their annual media trends report. One of the headlines from the report is the increase in propensity for subscribers to churn. Historically likelihood of cancellation has been low at around 20%, this has jumped to 38% in February 2021. Why the near doubling in cancellation rates? Part of the issue is the breadth of choice of paid services consumer now have. There are over 300 subscriber video on demand platforms in the US alone. A further threat to paid services are the growing number of ad supported services. 60% of those surveyed said they were willing to watch up to six minutes of ads per hour. Other insights include:

Deloitte estimate customer acquisition costs of up to $200 per subscriber - customer retention is going to become a major focus

82% of people are paying for a video streaming service, but the number they’re paying for has dropped from 5 in October to 4 in February

There’s a lot of shifting between services, 33% had both added and cancelled a paid service in the past year

The challenge for streaming services and more broadly for all paid subscriptions is shifting from acquisition to retention. More information on the report can be found here.

Has Netflix growth stalled?

Despite beating earnings and revenue targets, generating $7.2 billion in Q1 Netflix shares fell by as much as 11% after publishing its Q1 results. The drop in share price was driven primarily by the company missing its subscriber target by 2.2 million. Netflix claimed the miss in subscriber numbers was a combination of 2020 having pulled forward subscribers and a lower level of content being released to acquire new subscribers. But the markets and analysts felt the reason for the slowdown was the increased competition from Disney+, HBO Max and the 298 others noted above. Netflix dispute this pointing to the fact that they’re in a broader battle for user attention - citing video gaming and user generated content. In what may be a signal to future developments the letter to shareholders mentions revenue and engagement as the key indicators of success. Great coverage by the New York Times here and you can find the letter to shareholders here.

Apples and Pears

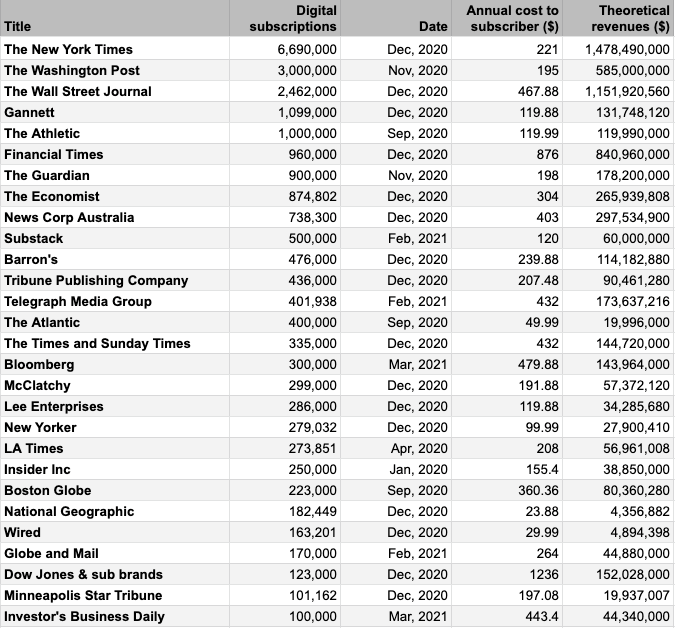

The Press Gazette compiles the 100k Club - English language news publishers who’ve reached more than 100,000 digital subscribers. As you can see from the above the club contains a slightly strange mix of members. The rationale must be that they’re all competing for digital subscribers, although I’m not sure you can compare Substack’s performance to Bloomberg’s? Context matters for any subscription business, especially in terms of pricing. The data compiled provides some interesting signals but when it comes to pricing needs to be viewed carefully. Many of the publishers listed offer heavily discounted, long term subscriptions which would dilute the revenue figures suggested. The Press Gazette provides a brief commentary on each entrant here.

Table stakes

WAN-Ifra has published a report on the impact of its Table Stakes initiative, a 12 month programme to assist publishers in building digital operations and importantly subscribers. Table stakes refers to the minimum skills / competencies / approaches required to operate digitally. They were devised by Doug Smith creator of the principles for “Challenge centric, performance driven, transformation programmes. The table stakes are:

Serve targeted audiences with targeted content / experiences

Publish on the platforms used by your targeted audiences

Produce and publish continuously to match your audiences lives

Funnel occasional users into habitual, valuable and paying loyalists

Diversify and grow the ways you earn revenue from the audiences you build

Partner to expand your capacity and capabilities at lower and more flexible costs

Drive audience growth and profitability from a “mini-publisher” perspective

These all seem like skills or approaches you need to succeed with digital. Although I’m not sure whether number 2 is followed by those on the programme or can be done without some limits. What’s missing from the list? Data, it may be its so fundamental that it isn’t mentioned. But collection and use of data has to be at the heart of any strategic and company culture change in order to succeed. Examples of the implementation of these can be found in the report.

Quick links

HBO Max gains 3 million subscribers in Q1. The growth looks to be driven by film releases such as “Godzilla vs. Kong” - is this sustainable?

Refresh your wardrobe - LK Bennet and Moss Bros are launching subscription based clothing rental services.

The Guardian - returned furlough money to the UK government as it produced better than expected results. Digital revenues (a combination of one-off donations and subscriptions) rose by 61% to £69 million.